CBDCs (Central Bank Digital Currencies) vs. Cryptocurrencies: Competition or Coexistence?

Introduction

In today’s fast changing financial world two digital money systems are getting a lot of attention:

Cryptocurrencies like bitcoin and Ethereum.

Central bank digital currencies (cbdcs) issued by governments.

First, they may look the same because both are digital forms of money. But in reality, they are very different. The big question is: will CBDCs cope with cryptocurrencies, or will both exist side by side?

Let’s break this down step by step in an easy way.

What are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that run on blockchain technology. They are not controlled by any government or central authority.

Example: Bitcoin, Ethereum, wave (XRP), Litecoin.

They operate in a decentralized way (no bank or government controls them).

Anyone with the internet can use them.

Supply is often limited (like bitcoin with a cap of 21 million coins).

In short, cryptocurrencies give people freedom from traditional banks.

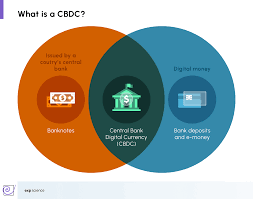

What are CBDCs?

The CBDC central bank stands for digital currency.

This is digital money issued by a country’s central bank.

This is not a new cryptocurrency, but a digital version of government money.

Example:

China’s digital yuan (e-CNY )

Sand dollar of the Bahamas

India’s digital rupee

Enaira of Nigeria

The CBDC is supported by governments and is legal tender (such as cash).

The main differences between CBDCs and Cryptocurrencies

Characteristic Cryptocurrencies CBDCs

Control decentralization, no government control controlled by the Central, Central Bank

Supply often limited (e.g., Bitcoin = 21m max) Unlimited, controlled by the government

Value stability highly stable, linked to the national currency

Legal status-not official legal tender (mostly) official government money

Privacy more anonymous less anonymous (government can track)

Technology blockchain, peer-to-peer blockchain or central digital ledger

Why governments are starting CBDC

Governments are interested in the CBDC for a number of reasons. :

Fast payments-people can quickly transfer money without the need for physical cash.

Financial inclusion-even people without bank accounts can access digital money.

Lower costs-the cost of printing and handling cash. CBDCs save that price.

Fight crime-governments can track digital transactions to reduce fraud or money laundering.

Compete with cryptocurrencies-if people move from local currency to crypto, CBDCs bring them back.

Why people still like Cryptocurrencies

Even with CBDCs coming, many people love cryptocurrencies because:

Freedom – no government control .

Shortages-supply of some coins (such as bitcoin) is limited.

Global Access-works anywhere in the world.

High returns – although dangerous, cryptos can give huge profits.

Privacy-tracking transactions can be difficult compared to Cbdcs.

Cbdcs Vs Cryptocurrencies: competition

Some experts believe that CBDCs and cryptocurrencies are competitors. Here’s why:

Governments want control over the flow of money, while cryptos challenge it.

CBDCs offer stability, while cryptos are unstable.

People can prioritize crypto for investment and cbdcs for daily transactions.

Some countries have banned or banned cryptocurrencies when launching cbdcs (such as China).

This shows a clear conflict of interest between the two.

Cbdcs Vs Cryptocurrencies: coexistence

Other experts believe that CBDCs and cryptocurrencies can coexist. :

CBDC can be used for everyday purchases and salaries.

Cryptocurrencies can be used for investments, cross-border payments and digital assets (NFTs, DeFi, Web3).

Both serve different purposes:

Cbdcs = government-backed money

Cryptos = decentralized financial independence

So instead of changing each other, they can work side by side.

Benefits of Cbdcs

Trust-government support.

Stability-associated with the price of real currency.

Performance-quick, cheap transactions.

Security-protected by the central bank.

Financial inclusion – helps the non-bank population.

Advantages of Cryptocurrencies

Decentralization – no single authority in control .

Transparency-the blockchain is open and trackable.

Global nature-can be sent across borders without restrictions.

Innovation powers DFI NFTS and Web3

Potential returns-investment opportunities with high growth.

Challenges for the CBDC

Privacy concerns-governments can monitor costs.

Technology threats-cyber attacks or technical failures.

Adoption issues-people are hesitant to rely on new digital money.

The impact of the banking sector-can disrupt traditional banks.

Challenges for Cryptocurrencies

Volatility-prices change quickly.

Regulation-many countries restrict or restrict crypto.

Security risks-Wallet Hacks, exchange scams.

Scalability-some blockchains are slow and expensive.

Real-world examples

China-strong CBDC push (digital yuan), while most crypto activities are banned.

U.S.-still researching CBDC but allows for crypto innovation.

Nigeria-introduced eNaira but adoption is slow; people still prefer bitcoin.

EU-testing the digital euro for future use.

These examples show how CBDCs and cryptos interact differently around the world.

Future perspective

The future will likely be a mix of competition and coexistence . :

CBDCs can dominate daily payments, salaries, and government transactions.

Cryptocurrencies can continue to grow in investment, global trade, and blockchain ecosystems.

Governments can create rules to balance innovation with financial stability.

In the long run, people can use both CBDCs and cryptocurrencies for different needs.

Result

Cbdcs and cryptocurrencies are two sides of digital money, but with very different purposes.

CBDCs = stability, control, and government support.

Cryptocurrencies = independence, decentralization, and innovation.

Instead of overhauling each other, they can coexist, with CBDCs used for day-to-day transactions and cryptos powering the wider digital economy .