Cross-Border Transactions: Legal and Security Considerations

Introduction

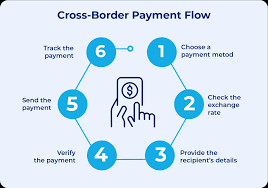

Cross-border transactions are becoming an important part of the global economy. Whether individuals are sending remittances abroad to their families, multinational corporations are making international payments, or traders are buying and selling across borders, the movement of money internationally is now faster and more frequent than ever. With globalization and digital financial systems, transactions that once took days or weeks can now be completed in minutes.

However, despite these benefits, cross-border payments come with a wide range of legal, regulatory and security challenges. From money laundering risks to compliance with various regulations in the jurisdiction, careful consideration is required to ensure smooth and legal action of international transactions.

This article examines the legal and safety considerations of cross-border payments, highlighting the complexities faced by businesses, regulators and individuals.

The importance of cross-border transactions

Cross-border payments are at the centre of international trade and finance. Trillions of dollars move across borders every day, powering imports, exports, tourism, remittances and investment, according to the bank for International Settlements (BIS).

Key areas where cross-border transactions play a role:

International trade companies import/export goods and services to countries .

Remittances-millions of migrant workers send money back to their home countries.

Foreign Direct Investment (FDI) – investors transfer funds across borders to fund businesses.

Global e-commerce-online marketplace allows people to buy and sell internationally.

Financial markets-stocks, bonds, and cryptocurrencies flow across the border into capital.

While the transactions fuel growth, they are also targets for fraudsters, money launderers and cybercriminals. They also raise questions of legal jurisdiction, taxes and compliance.

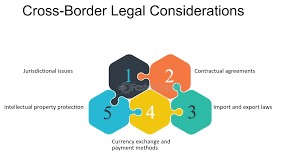

Legal considerations in cross-border transactions

Cross-border transactions are subject to a number of overlapping legal frameworks. Payments transferred from one country to another can go through several legal jurisdictions, each with its own rules. This creates complexity and risk for both individuals and institutions.

1. Anti-money laundering (AML) and counter-terrorism financing (CTF)

The biggest legal concern in cross-border transactions is the risk of money laundering and terrorist financing. Criminals often try to transfer illegal money across borders to hide its origin.

Most countries implement AML/ctf regulations that require banks and financial institutions to verify customer identity (know your customer – KYC).

Suspicious transactions must be reported to the authorities.

Non-compliance can result in hefty fines, as seen in a number of cases against global banks.

2. Restrictions and trade restrictions

Countries may impose economic sanctions or trade sanctions on certain countries, companies or individuals. For example:

U.S. sanctions against Iran or North Korea limit financial dealings with institutions in these areas.

Violation of restrictions can lead to severe penalties, damage to reputation and legal consequences.

This means businesses must carefully check transactions to ensure they are not dealing with unwittingly approved entities .

3. Tax and double taxation issues

Cross-border payments often raise tax compliance challenges:

Businesses may face withholding taxes on payments such as royalties or dividends.

Individuals can be taxed twice (once in the country of origin and then in the country of residence).

Double tax agreements (DTAs) between countries help reduce this burden.

Failure to comply with tax laws can result in legal disputes and financial penalties.

4. Data privacy and cross-border data transfer laws

Many transactions require customer data to be shared across borders . However data protection laws are different:

The EU’s GDPR has strict rules on transferring personal data outside the EU .

Some countries require data to be stored locally (data localization laws).

The rules could complicate cross-border financial flows, as banks and fintech firms must ensure compliance with a number of privacy frameworks.

5. Jurisdiction disputes

A common challenge is deciding which country’s law applies in the event of disputes . For example:

If an international payment is fraudulent, is the sender or recipient’s country responsible ?

Courts can struggle with enforcement across borders, leading to lengthy legal battles.

It highlights the need for international cooperation in the legal framework governing cross-border transactions.

Security considerations in cross-border transactions

As well as legal compliance, security risks in international payments are among the biggest challenges. Cybercriminals target cross-border flows due to large sums of money and multiple intermediaries.

1. Cybersecurity threats

Phishing attacks: fraudsters trick individuals into revealing banking details.

Hacking and malware: hackers target financial institutions ‘ systems.

Ransomware attacks: criminals demand payment to unlock the system.

Cross-border payments are particularly weak because they often involve multiple banks and networks .

2. The dangers of fraud

Plans to defraud international payments include::

Business email compromise (Bec): criminals impersonate company executives to trick employees into sending money overseas.

Fake receipts: fraudsters send fake international receipts to steal funds.

Identity theft: criminals use stolen identities to open accounts and transfer money.

3. Weaknesses of the SWIFT network

Most international bank transfers use the SWIFT (Society for Worldwide Interbank Financial Telecommunications) System. Despite being safe, it has been exploited in the past.

In 2016, hackers stole 8 81 million from Bangladesh Bank through SWIFT.

Weak internal security at local banks can expose the entire network.

4. Cryptocurrency risks

Cryptocurrencies are increasingly used in cross-border payments because they are faster and cheaper. However:

They are highly volatile, making pricing difficult.

They are sometimes used for illegal transfers due to anonymity.

Exchanges and wallets face hacking risks.

Governments are now pushing for tougher regulations on crypto cross-border transactions.

5. Regulatory technology (RegTech) and compliance security

To mitigate risks, many financial institutions use regtech tools for real – time compliance:

AI-powered transaction monitoring.

Blockchain-based auditing .

Biometric authentication for secure access .

These technologies help reduce fraud and ensure a smooth flow of cross-border payments.

Solving legal and security challenges

1. Strong international cooperation

Harmonization of AML/CTF rules in countries .

Bilateral and multilateral agreements to resolve disputes .

Shared databases of fake entities .

2. Improved compliance program

Companies must adopt a strict KYC/AML process.

Regular staff training to detect suspicious activity.

Using AI to flag unusual cross-border payments .

3. Adopting blockchain technology

The blockchain offers transparency and invariance, reducing fraud .

Payments can be verified in real time.

Smart contracts can automate compliance checks .

4. Better cyber security measures

Multi-factor authentication for all international payments.

Regular security audits and penetration checks .

Encryption of sensitive financial and customer data .

5. Central bank digital currencies (CBDCs )

Many countries are looking to CBDC to improve cross-border payments.

CBDCs can reduce dependence on mediators.

They can ensure compliance with regulations while reducing fraud .

Case studies

Case 1: Bangladesh Bank Robbery (2016)

Hackers used the SWIFT system to steal ڈالر 81 million.

When a weak link is exploited, cross-border payments weakness appears.

Case 2: remittances in developing countries

Migrant workers send billions of dollars home annually .

High fees (often 7-10%) highlight the need for cheaper, safer systems.

Case 3: crypto payments in cross-border trade

Some businesses now accept crypto to avoid high bank fees .

Regulatory uncertainty, however, poses legal risks.

The future of cross-border transactions

Fast and affordable payments-measures such as RippleNet and cbdcs aim to reduce costs and processing times.

Global regulation-the Financial Action Task Force (FATF) is pushing for global AML/CTF standards.

AI-powered fraud detection machine learning will enhance real-time monitoring.

Overuse of Blockchain-to improve transparency and reduce conflict.

The future of cross-border payments will likely balance performance with legal and security considerations .

Result

Cross-border transactions are essential for the functioning of today’s interconnected global economy. However, they come with significant legal and security challenges, including AML/ctf compliance, restrictions, taxes, data privacy, fraud risks, and cyber security risks.

By adopting technical solutions such as blockchain, RegTech, and AI and promoting international cooperation, the world can create safer, faster, and more transparent systems for cross-border transactions.

For businesses, individuals and regulators, understanding these legal and security considerations is critical to navigating the future of global finance.