Stablecoins vs. Traditional Cryptocurrencies: Key Differences and Uses

1. Introduction-two sides of the crypto world

Cryptocurrencies come in several forms, but the two most talked about types are traditional cryptocurrencies (such as Bitcoin and Ethereum) and stablecoins (such as USDT and USDC).

Both are digital money, but they work differently and have different goals.

To understand them, think of:

Traditional cryptocurrencies as wild roller coasters-prices go up and down a lot .

Stablecoins as a quiet boat-prices remain stable .

In this guide, we’ll explore what they are, how they work, their differences, and where people use them.

2. What are traditional Cryptocurrencies?

Traditional cryptocurrencies are digital coins that:

Are not controlled by any one person or company (decentralized).

Use blockchain technology to record transactions.

There are prices that change based on supply and demand.

Examples

Bitcoin (BTC) – the first cryptocurrency, mainly used as a shop of digital gold or price.

Ethereum (ETH) – used to create apps, smart contracts and NFTs.

Litecoin (LTC) – a fast payment version of bitcoin.

Main features

Volatility: prices can rise or fall quickly.

Limited supply: there is a fixed number of many coins (bitcoin is 21 million).

Global use: can be sent to anyone with an internet connection.

3. What are Stablecoins?

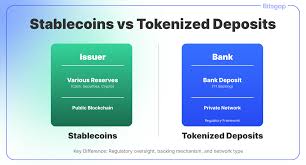

Stablecoins are cryptocurrencies designed to keep their price stable.

Instead of going up and down like traditional coins, they stay connected to something stable, usually a real-world currency like the US dollar .

Examples

Tether (USDT) – attached to the US dollar, 1 USDT ≈ 1.

USD Coin (USDC) – another US dollar-linked stablecoin.

DAI-connected to the US dollar but maintained by a smart contract system.

How they stay stable

Fiat-backed Stablecoins-each coin has real money support in a bank account .

Crypto-backed stablecoins-in collaboration with other cryptocurrencies with additional collateral.

Algorithmic stablecoins-use computer programs to adjust the supply and keep the price stable.

4. The main differences between Stablecoins and traditional Cryptocurrencies

Characteristic Stablecoins traditional Cryptocurrencies

Price stability price remains the same (e.g., market 1) price change based on the market

Significant usage payments, trading, storage price investments, long-term holding, apps

Risk low price risk but still depends on the higher price risk of issuer confidence due to volatility

Backing is often not supported by dollars assets or algorithms usually physical assets

Volatility less high

Regulation often more regulated varies widely by country

5. Use of traditional Cryptocurrencies

a) long-term investment (huddling)

Many people buy Bitcoin or Ethereum in the hope that their price will rise over the years.

B) decentralized applications

Ethereum and similar coins let developers build apps without the main company .

C) international transfers

People send bitcoin to family or friends abroad, avoiding bank fees .

D) digital gold

Treat bitcoin like some gold-a safe asset against inflation.

6. Use of Stablecoins

a) day-to-day payments

Stablecoins can be used to buy goods and services without worrying about price swings.

B) trading in crypto exchanges

Traders regularly use stablecoins to move quickly between coins without returning money.

c) cross-border transactions

Send money immediately and cheaply abroad, the price remains the same .

d) DeFi (decentralized finance)

Stablecoins are widely used to lend, borrow and gain interest in DFI platforms.

7. Advantages of traditional Cryptocurrencies

High growth potential: prices can rise greatly if demand increases.

Decentralization: no authority controls them.

Innovation: enable smart contracts, NFTs, and blockchain apps.

Shortages: fixed supply can increase in value over time.

8. Benefits of Stablecoins

Price stability: no major volatility .

Fast and affordable transition: good for daily use .

Bridge over crypto: the easy way for new users to enter the crypto world.

Good for traders: avoid switching to regular currency every time.

9. The dangers of traditional Cryptocurrencies

Volatility: prices can fall sharply .

Regulatory uncertainty: some countries ban or restrict them .

Security risks: there may be hacks and scams.

Technology threats: bugs or problems in the blockchain code.

10. Stablecoins risks

Confidence in the issuer: if a company does not have enough reserves, it may fail.

Regulation: governments may control or restrict certain stablecoins .

Depegging: if the dollar link breaks, the price may fall.

Centralization: many stablecoins are controlled by a company.

11. Which one should you use ?

Use traditional cryptocurrencies if you like:

Long-term investment opportunities.

Supporting decentralized apps or projects.

A store priced like digital gold .

Use Stablecoins if you wish:

To avoid big price changes.

To make fast, affordable payments .

To trade between cryptocurrencies without leaving the market.

12. Real life examples

A freelancer in India is paid in USDT from a client in the US, avoiding bank delays.

An investor buys bitcoin and keeps it for 5 years, hoping its value will rise.

A DeFi user collects USDC in a lending platform to earn interest without worrying about a price drop .

13. The future of Stablecoins and traditional Cryptocurrencies

Experts expect:

Stablecoins will be used by online shopping, salaries, and even governments as central bank digital currencies (CBDCs).

Traditional cryptocurrencies to continue as investment assets and platforms for innovation in blockchain technology.

A future where the two work together-stable coins for daily use, traditional coins for development and innovation.

14. Result-two tools, two goals

Stablecoins and traditional cryptocurrencies are like two different tools in the world of digital money:

Made for a consolidation and daily transactions .

The second is designed for growth, investment and innovation.

Understanding the differences helps you choose the right one for your needs — and maybe even use both for different purposes.