The Role of Decentralized Autonomous Organizations (DAOs)

Introduction to DAOs

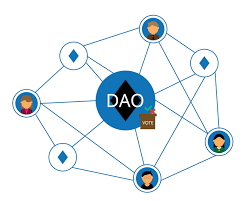

In the rapidly developing world of blockchain and cryptocurrency, Decentralized Autonomous Organizations (DAOs) have emerged as one of the most innovative and disruptive concepts. DAO is primarily a community-led organization that operates without central leadership . Unlike traditional companies or institutions that rely on boards of directors or executives, daos work through smart contracts and blockchain technology. This allows members around the world to participate in decision-making, resource allocation and governance in a transparent and democratic manner. The idea behind Daos is that human error ، Corruption and centralized control should be reduced while creating an open structure where rules are encoded in software.

DAOs are redefining how communities, businesses and even governments can function. They represent a vision of collective ownership where everyone has a voice and where financial resources are driven by consensus rather than Authority. With their unique ability to decentralize power, DAOs are fast becoming the cornerstone of the Web3 ecosystem, combining blockchain technology with governance structures that may one day rival or even replace traditional institutions.

What is Dow?

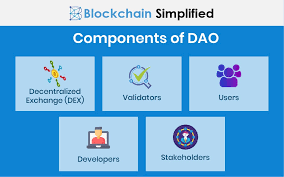

DAO is an organization run by rules written in computer code and executed on a blockchain. These rules, often known as smart contracts, are self-governing contracts that automatically take action once the pre-defined conditions are met. For example, if the DAO votes to allocate funds to a project, the smart contract will automatically transfer those funds without the need for a human arbitrator .

Unlike traditional organizations, Dao does not require a CEO or management team to make decisions. Instead, governance tokens are often used to grant voting rights to members. Token holders can propose measures, vote on strategies, and shape the direction of the organization. Every transaction proposal and decision is recorded on the blockchain making DAOs transparent audible and difficult to manipulate

Historical background and evolution

The DAOs concept was first introduced around 2015 when blockchain developers began experimenting with governance structures beyond cryptocurrencies. The most notable early example was Dao, a decentralized venture capital fund built on Ethereum in 2016. While it raised more than 1 150 million worth of ether, it also exposed risks when hackers exploited a flaw in its code, leading to a massive loss of funds. The episode highlighted both DAOs ‘ promise and risks, sparking fierce debate within the blockchain community.

Since then, the DAWs have matured significantly . Developers have learned from past mistakes, introducing better security measures, governance mechanisms, and community participation frameworks. Today, DAOs work in industries—from finance and gaming to philanthropy and social networks-demonstrating their versatility and long-term potential.

The main features of DAOs

Dao has several key features that set them apart from traditional organizations. :

Decentralization-no central authority controls the DAO. Instead, decisions are made collectively by participants.

Transparency-all decisions and transactions are visible on the blockchain, ensuring openness.

Autonomy-once deployed, DAOs act automatically according to their smart contracts, reducing reliance on human intervention.

Global access-anyone with internet access and compatible tokens can participate, really create border communities.

Democratic governance-decisions are made by token holders, who provide an equal opportunity to get involved regardless of geography or background.

These features make DAOs unique, offering a governance model that can be more comprehensive and effective than traditional rating systems.

How DAOs works in practice

DAOs operate using a combination of smart contracts and governance tokens. Smart contracts handle the technical implementation of the rules, while governance tokens empower members to propose and vote for measures. For example, a DAO focused on funding blockchain startups could allow token holders to propose projects, discuss their potential, and ultimately vote to approve or reject funding . Once the decision is made, the smart contract automatically releases funds .

This model eliminates the need for intermediaries such as banks, legal advisers, or corporate executives. Members directly control the organization’s Treasury and strategic direction . This decision-making democracy promotes inclusion, as people from different backgrounds can contribute without being bound by traditional gatekeepers.

Types of DAOs

Over time, different types of DAOs have emerged to serve different purposes:

Protocols govern blockchain-based protocols such as DAOs-Uniswap and MakerDAO, where token holders vote on upgrades, fee structures, or treasury management.

Investment Daos-pool resources from members to invest in projects, startups, or digital assets, much like decentralized venture capital firms.

Focus on acquiring valuable digital assets such as collector DAOs-nfts. Examples include PleasrDAO and Flamingo DAO.

Grant Daos fund projects that align with specific missions are often used in the open source software community .

Social DAOs-create communities around shared values, interests, or goals, fostering collaboration and networking.

Daos channel funds for philanthropy for charity in a transparent way, ensuring that donations are used effectively .

Each type of Dao benefits blockchain governance in unique ways, but all share the principle of decentralization.

The benefits of DAOs

DAOs bring several benefits that appeal to traders investors and communities:

Transparency and trust: since all actions are recorded on the blockchain, participants can verify decisions and transactions themselves.

Efficiency: automated processes reduce the costs associated with bureaucracy, procrastination and traditional organizational structures.

Inclusion: Daos empower individuals worldwide to participate regardless of geographical or economic barriers.

Resilience: without central authority, DAOs are less prone to corruption, censorship, or elimination.

Innovation: DAOs fosters creativity, encourages experimentation with new governance and business models.

Daos challenges and criticism

Despite their potential DAOs faces several challenges:

Security risks: vulnerabilities in smart contracts can be exploited by hackers, as seen in the DAO hack.

Regulatory uncertainty: governments struggle to legally classify Daos, raising questions about taxes, liability and compliance .

Scalability issues: large communities can find it difficult to reach consensus quickly, slowing decision-making.

Participation inequality: in practice, voting power may be concentrated in the hands of wealthy token holders, undermining justice.

Lack of legal identity: without a clear legal framework, DAOs often faces difficulties in communicating with traditional institutions.

These issues highlight that while DAOs are revolutionary, they are a work in progress.

The role of DAOs in DeFi

One of DAOs’s most successful applications is within decentralized finance (DeFi). Daos manages lending protocols, liquidity pools and stablecoins, allowing customers to create financial services without banks. MakerDAO, for example, governs DAI stablecoin, enabling consumers to propose implicit requirements or interest rate changes. Similarly, Uniswap’s governance Dao oversees upgrades and fee structures for one of the largest decentralized exchanges in the world.

In this context, DAOs shows how decentralized governance can affect the financial sector, offering more democratic alternatives to traditional institutions.

DAOs in other industries

Beyond DeFi DAOs are expanding into diverse industries:

Gaming: play-to-earn communities such as yield Guild games use DAOs to manage assets and reward players.

Art and culture: Daos such as PleasrDAO acquire and manage high-value NFTs, democratizing art ownership .

Philanthropy: charitable DAOs ensure transparent use of donations, building trust among donors.

Media and content creation: communities pool resources to fund independent journalism or creative projects, free of corporate influence.

The adaptation of DAOs makes them a powerful model for innovation in sectors.

Regulatory perspectives on DAOs

The biggest question surrounding Daos is how governments will regulate them. Currently, DAOs exist in a grey area because they do not fit neatly into existing corporate or non-profit categories. Some jurisdictions, such as Wyoming in the United States, have taken steps to recognize Daos as legally limited liability companies (LLCs). It gives Daos legal protection while allowing them to operate more openly.

However, most areas still lack regulatory clarity . Governments are concerned about issues such as money laundering, investor protection and accountability in the event of disputes. Striking a balance between enabling innovation and protecting consumers will be key to DAOs ‘ future.

The future of Davos

As blockchain adoption continues to grow, DAOs is likely to play an increasingly important role in global governance, finance, and community building. Future Daos can manage large-scale organizations, cities or even national governments, offering transparent and democratic alternatives to traditional political systems.

Technological advances, such as improved scalability solutions and cross-chain interoperability, will make DAOs more efficient. At the same time, the clear legal framework will help Daos integrate into the mainstream economy. Over time, DAOs can redefine the concept of ownership, governance and cooperation in ways that we are only beginning to imagine.

Result